Our finance minister had announced in the Union Budget that a facility for an instant e-PAN shall be launched. Accordingly, this facility has been launched and available where taxpayers can apply for PAN basis the Adhaar they hold. Through this facility, applicants can apply and get PAN immediately and free of cost.

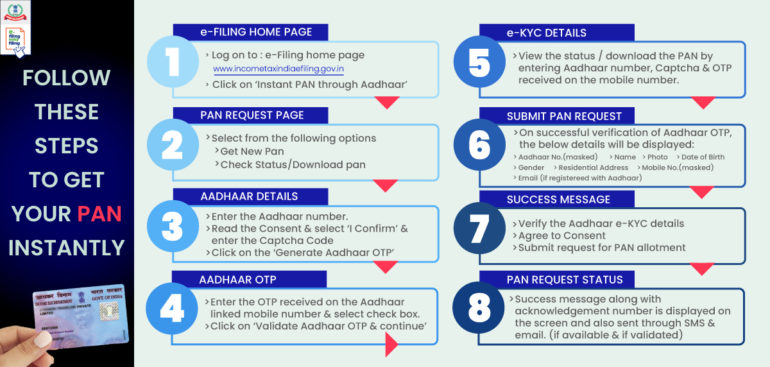

This facility of applying for e-PAN is based on Aadhaar e-KYC and is available on the income tax e-filing portal. One can apply for PAN through this facility if he /she never had PAN and have Aadhaar and the mobile number which is linked to Aadhaar is active and working. Thus, this facility shall not apply to a case for a re-issue of a PAN or where the applicant does not hold an Aadhar or the mobile number linked to it is not active. Once these basic conditions are met, the process for application is very simple and quick.

For FAQs, please click below:

Jitesh Telisara & Associates LLP, CA In Kalyani Nagar is a professionally managed firm catering to domestic and international clients with a broad range of services in domestic and international taxation, regulatory and advisory services and crosses border transaction-related services.

The team at the firm has dedicated and experienced professionals and associates like Chartered Accountants, Company Secretary and Consultants to provide end to end services to your business. With the effort of gaining a deep understanding of your business, the team is committed to providing valuable, consistent and efficient services based on its in-depth knowledge and wide experience in the areas of audit, taxation, regulatory compliances, and related business services.

Our services: GST Consultant, IT returns consultant, Corporate law, Taxation, Regulatory & Advisory Services