Every time a person files an Income Tax Return, an acknowledgement is generated. This acknowledgement is known as ITR-V. This means Income Tax Return Verification Form. Once the return is filed, it has to be verified either through Adhaar Based OTP or through net banking.

When the Goods and Service Tax Act was introduced, there were many doubts and clarifications were raised by industries as to what falls within the ambit of GST and what does not? GST is levied and applicable to the supply of goods and services.

Know the applicability of ITR Forms for AY 2020-21.

Ministry of Corporate Affairs has introduced DIR-3 e-KYC to conduct KYC verification for all the persons who have been allotted DIN (Director Identification Number). DIN is a unique 8 digit number allotted to a person who wishes to become a director of a company. Thus any person who holds a DIN is mandatorily required to file DIR-3 KYC with MCA.

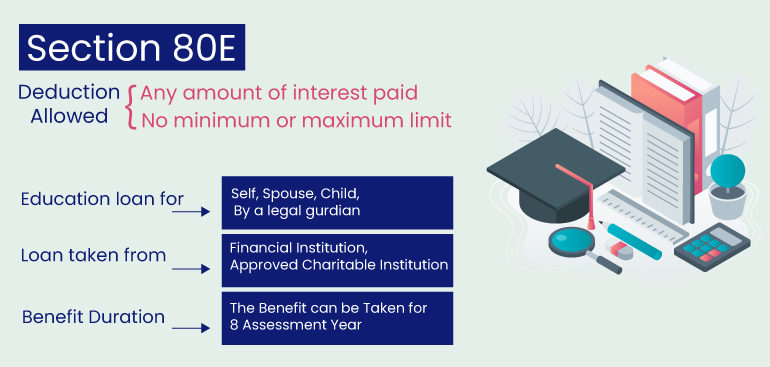

In today’s times, getting a higher education has become a point of concern where the fees for such education are touching the sky. As they say, the only thing costlier than education is ignorance.

Central Board of Direct Taxes announces an open window for one time to complete verification of ITRs filed electronically in the past years but is pending for verification.

It is always advised to everyone that better be safe than worry. It applies not just for health but also financial requirements for health. Thus, health insurance, popularly known as medical insurance is an important and mandatory investment in your investment portfolio. To encourage this investment, government provides tax benefits in the form of deduction of the investment made in medical insurance. This tax benefit is over and above of the investments stated under Section 80C/CC/CCD and is claimed under section 80D.

In order to promote digital financial transactions and curb cash transactions, the government has introduced Section 194N in the Union Budget of 2019. This section is further amended by the Finance Act 2020, where tax has been imposed in the form of TDS on cash withdrawal above Rs 1 crore by any taxpayer.

The donors shall be eligible to claim 100% of the amount of donation as a deduction under section 80G of the Income Tax Act while filing their income tax returns.

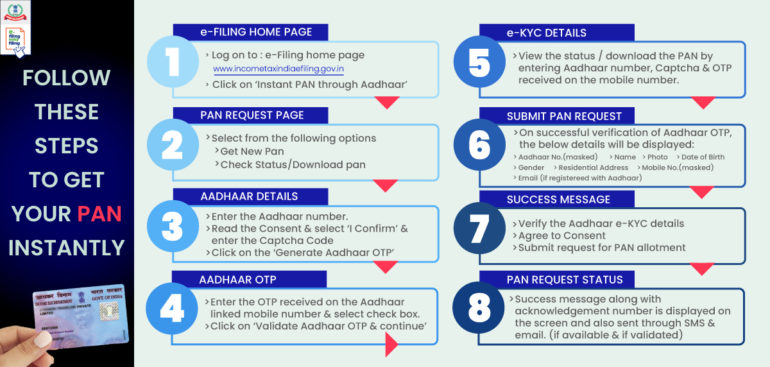

Our finance minister had announced in the Union Budget that a facility for an instant e-PAN shall be launched. Accordingly, this facility has been launched and available where taxpayers can apply for PAN basis the Adhaar they hold. Through this facility, applicants can apply and get PAN immediately and free of cost.