Income Tax Act has broadly defined taxability of income under five heads of Income. One of them is Capital Gain, where gains arising out of sale of capital assets are taxable in the hands of the seller of the capital asset. However, with the intention of tax evasion, assesses started entering into an agreement with the buyer, where the sale value declared by the seller is less than the actual sale consideration. This led to loss of tax to the government, and thus to avoid this, section 50C and Section 56 (2)(x) was introduced as two sides of a coin. Section 50C states taxability of such cases in the hands of the seller while Section 56 (2)(x) specifies about the taxability of such transactions in the hands of the buyer.

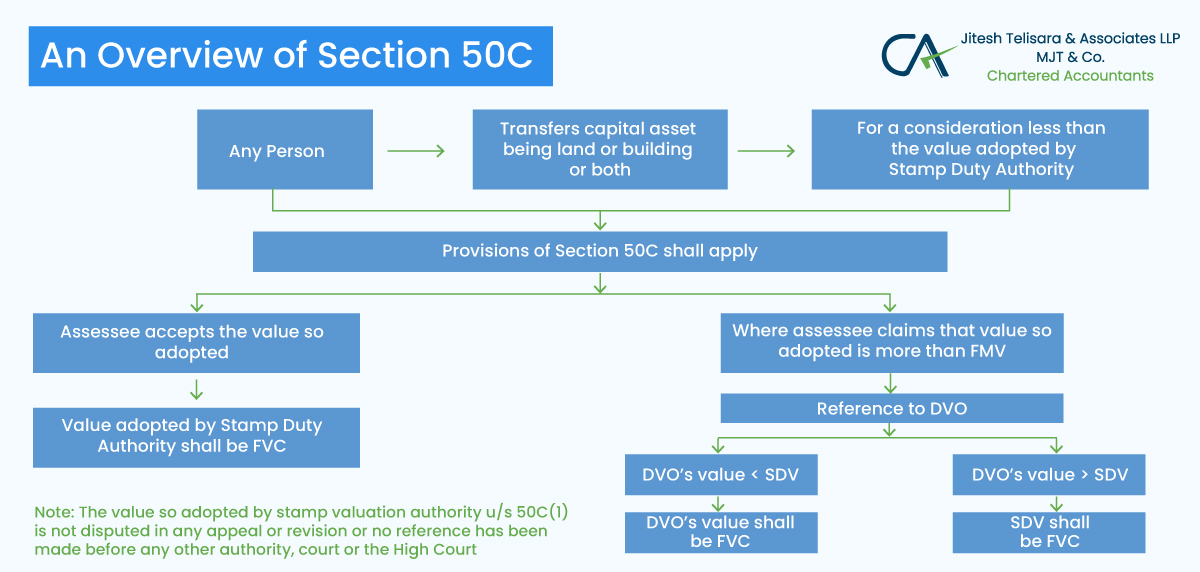

Accordingly, Section 50C becomes applicable, when an assessee receives or claims to receive a sale consideration, on sale of land or building or both, and such sale consideration is less than the value adopted (Stamp Duty Value / Circle Rate / Ready Reckoner Rate) by the Stamp Valuation Authority. As per the provisions of Section 50C, if the sale consideration declared by the assessee (seller) is less than the stamp duty value, then the stamp duty value shall become deemed sale consideration for the purpose of calculating capital gain tax. However, if the stamp duty value does not exceed 105% of the sale consideration received or to be received, then in such case, the actual consideration received or declared by the seller shall be the sale value for the purpose of capital gain tax. This limit is further increased, where if the stamp duty value does not exceed 110% of the sale consideration, then such sale consideration shall be the sale value for computing capital gain tax for the sale transactions w.e.f 1st April, 2021.

If in an instance, where the date of agreement to sell and the date of registration are not same, then the stamp duty value as on the date of Agreements shall be considered by the Stamp Valuation Authority, for the purpose of computing the deemed sale consideration. However, this shall be applicable only if the entire sale consideration or part of it has been received by the seller by way of an account payee cheque or a bank draft or through electronic clearing system, on or before the date of actual agreement of sale.

In order to safeguard the interest of the assesses incase of the genuine transactions, income tax act provides remedy to the seller, if in case, the assessee claims before the assessing officer that the stamp duty value adopted by the stamp valuation authority is higher than the fair market value of the asset (land or building or both), such assessing officer shall refer the valuation of such capital asset to the Valuation Officer. However, such reference to the valuation officer shall be made only if the stamp duty value adopted by the stamp valuation authority has not been disputed or challenged before any authority or any court.

If, after reference made to the valuation officer for the valuation of a capital asset by the assessing officer, the value ascertained by such valuation authority exceeds the stamp duty value, then in such case, the stamp duty vale adopted by the stamp valuation authority shall be considered as a deemed sale consideration for the purpose of computing capital gain tax in the hands of the seller. Thus it can be stated that the stamp duty value or the value ascertained by the Valuation Officer, whichever is lower, shall be deemed to be the sale consideration for the purpose of computing capital gain tax.

Where any land or building or both are sold by an assessee as other than capital asset (stock in trade) then in such case, Section 43CA shall be applicable, wherein if the sale consideration received or to be received by the assessee (seller) is less than the stamp duty value adopted by the stamp valuation authority, such stamp duty value shall be considered for the purpose of computing the profits and gains from the business arising out of such sale. However, if the stamp duty value does not exceed 110% of the sale consideration received or to be received, then such sale consideration shall be counted as sale consideration for the purpose of taxation. Further, if such asset is a residential unit, and the stamp duty value does not exceed 120% of the sale consideration received or to be received, then such sale consideration shall be considered as full sale value for the purpose of computing tax on profits and gains from the business, provided following conditions are satisfied:

- Such sale transaction takes place during the period from 12th November, 2020 to 30th June, 2021;

- Such sale is a first time allotment of a residential unit to any person;

- Sale consideration of the residential unit does not exceed two crore rupees.

All other provisions of Section 50C shall apply to such transactions where Section 43CA applies.

Flipping the coin – Taxability in the hands of buyer (Section 56 2 (x))

Section 56 2(x) is applicable where any assessee (buyer) receives any immovable property, without any consideration or at consideration which is lower than the stamp duty value of such property. In case the assessee receives the property without any consideration and the stamp duty value of such property exceeds rupees fifty thousand, then such stamp duty value shall be considered as deemed income of the assessee and shall be taxable in the hands of the receiver of the property as income from other sources. In case where the assessee, purchases any land or building or both at a consideration which is lower than the stamp duty value of such property, then the difference between the stamp duty value and the sale consideration shall be considered as income from other sources and shall be taxed in the hands of the buyer provided such excess amount exceeds rupees fifty thousand and also 10% of the amount of sale consideration.

Jitesh Telisara & Associates LLP, CA In Viman Nagar is a professionally managed firm catering to domestic and international clients with a broad range of services in domestic and international taxation, regulatory and advisory services and crosses border transaction-related services.

The team at the firm has dedicated and experienced professionals and associates like Chartered Accountants, Company Secretary and Consultants to provide end to end services to your business. With the effort of gaining a deep understanding of your business, the team is committed to providing valuable, consistent and efficient services based on its in-depth knowledge and wide experience in the areas of audit, taxation, regulatory compliances, and related business services.

Our services: GST Consultant, IT returns consultant, Corporate law, Taxation, Regulatory & Advisory Services