Every Limited Liability Partnership registered under the Limited Liability Act, 2008 has to make certain compliances. One of such compliance is the filing of Form 11 with Ministry of Corporate Affairs. Every financial year, an LLP has to file this Form 11 online on the MCA Portal.

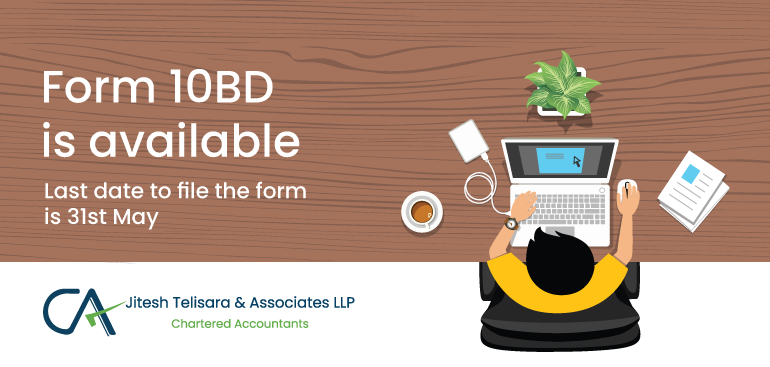

On 26th March, 2021 CBDT, through a notification, has notified (vide notification no 19/2021) that a Statement of Donation shall have to be filed with Income Tax Department, declaring the details of donations received during the year via Form 10BD and also a Certificate shall have to be issued via Form 10BE, to all such donors specified in Form 10BD. This notification has been brought up to ensure the transparency of the donations received and to bring into net all the bogus and fraudulent claims of donations.

Many taxpayers have received financial help from their employers and well-wishers for meeting their expenses incurred for treatment of COVID-19. In order to ensure that no income tax liability arises on this account, it has been decided to provide income-tax exemption to the amount received by a taxpayer for medical treatment from employer or from any person for treatment of COVID-19 during FY 2019-20 and subsequent years.

Income Tax Act, 1961 of India applies to all persons having income earned or accrued in India. However, its applicability differs basis the residential status of a person. The residential status as stated in Income Tax Act should not be considered as a synonym for citizenship of India.

Every time a person files an Income Tax Return, an acknowledgement is generated. This acknowledgement is known as ITR-V. This means Income Tax Return Verification Form. Once the return is filed, it has to be verified either through Adhaar Based OTP or through net banking.

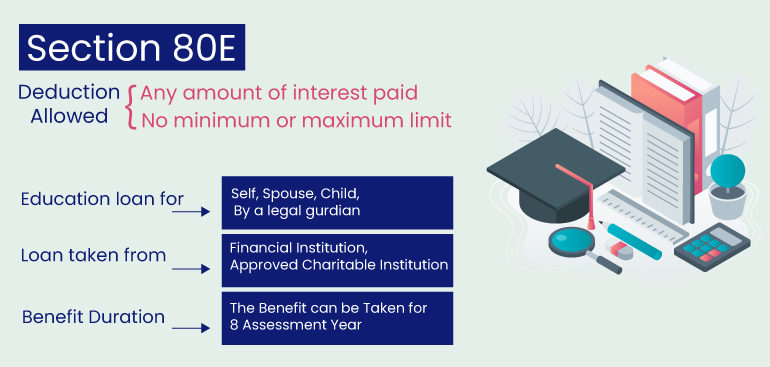

In today’s times, getting a higher education has become a point of concern where the fees for such education are touching the sky. As they say, the only thing costlier than education is ignorance.

Central Board of Direct Taxes announces an open window for one time to complete verification of ITRs filed electronically in the past years but is pending for verification.

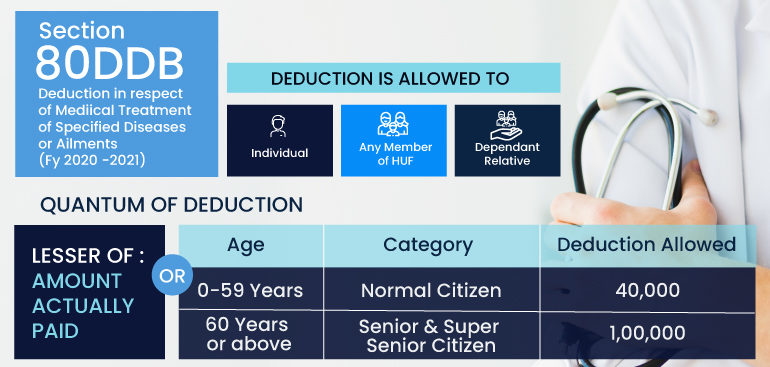

It is always advised to everyone that better be safe than worry. It applies not just for health but also financial requirements for health. Thus, health insurance, popularly known as medical insurance is an important and mandatory investment in your investment portfolio. To encourage this investment, government provides tax benefits in the form of deduction of the investment made in medical insurance. This tax benefit is over and above of the investments stated under Section 80C/CC/CCD and is claimed under section 80D.

In order to promote digital financial transactions and curb cash transactions, the government has introduced Section 194N in the Union Budget of 2019. This section is further amended by the Finance Act 2020, where tax has been imposed in the form of TDS on cash withdrawal above Rs 1 crore by any taxpayer.