How to make PTRC Payment

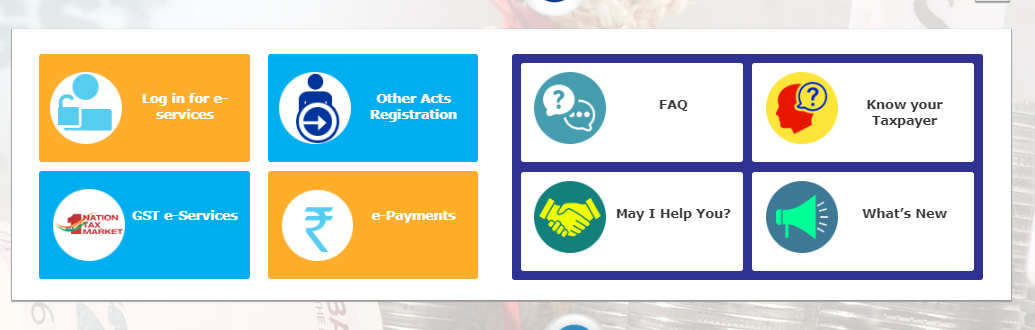

Step 1: The taxpayer has to visit the official website https://mahagst.gov.in/en/payments

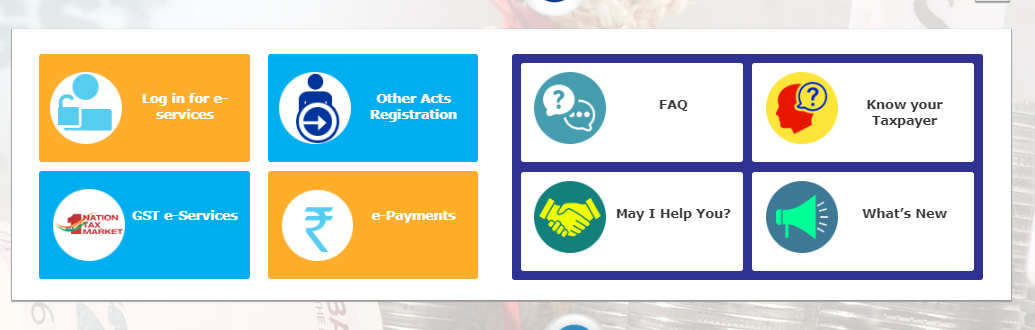

Step 2: From the home page, select e-payments option and then select e-Payment Returns option from the list.

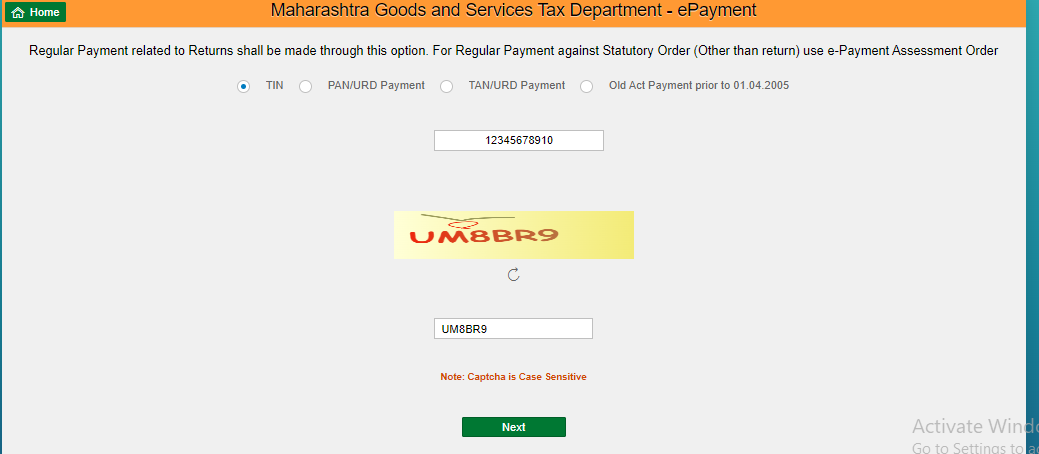

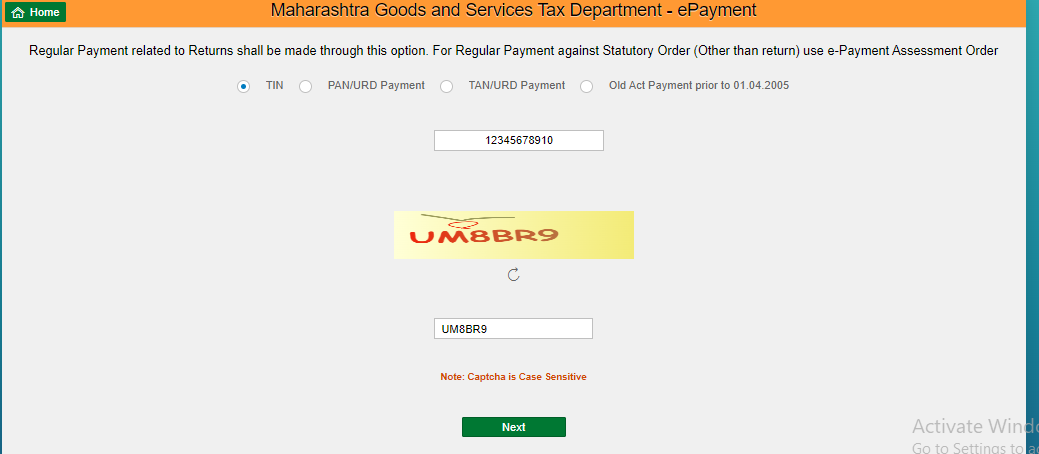

Step 3: The taxpayer needs to select TIN option and then Provide the Taxpayer Identification Number and enter Captcha.

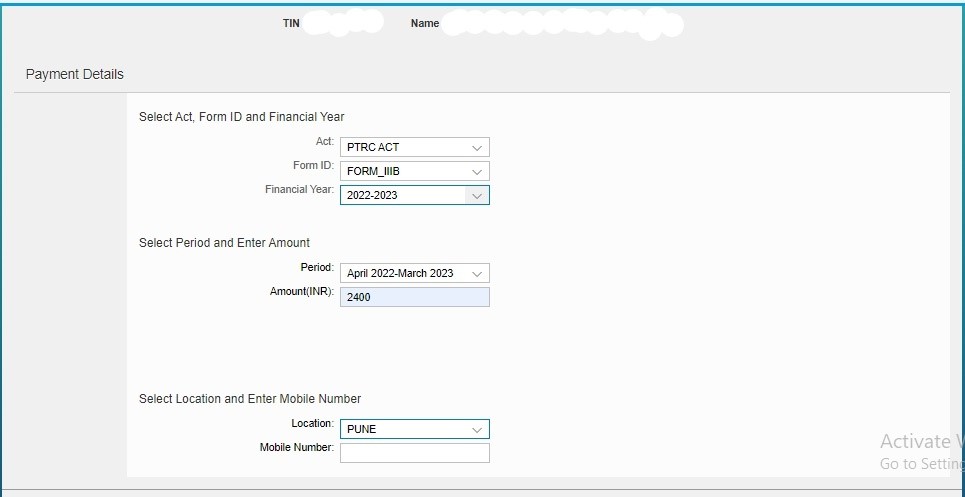

Step 4:

- The taxpayer will have to select the PTRC Period from the drop-down menu. If the periodicity of the dealer is available in the system for the selected financial year, then the period will be shown as per his periodicity.

- If periodicity is not available in the system, then option as Monthly, Quarterly, Six Monthly, Yearly will be shown. Select Monthly or yearly depending upon the previous year’s tax liability.

- After selecting the period, the taxpayer needs to provide the PTRC amount.

- Select the location and provide the mobile number.

- Once the details are provided, click on Proceed for Payment.

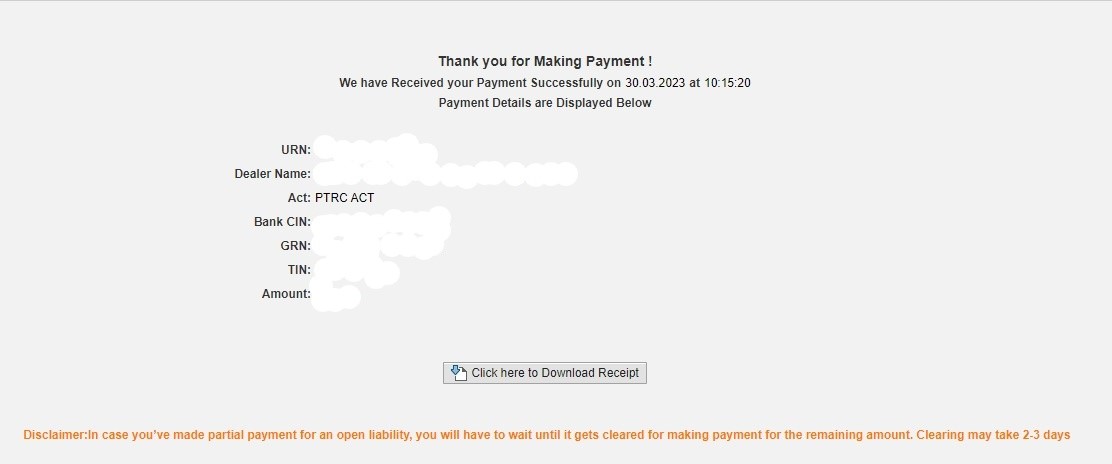

Step 6:

- A draft challan will appear, verify your details properly & click on “Make Payment”

- You can use a credit/ debit card or net banking for payment. You can download the receipt after successfully paying your professional tax

How to make PTEC Payment

Step 1: The taxpayer has to visit the official website https://mahagst.gov.in/en/payments

Step 2: From the home page, select e-payments option and then select e-Payment Returns option from the list.

Step 3: The taxpayer needs to select e-payments option and then Provide the Taxpayer Identification Number and enter Captcha.

Step 4:

- PTEC period will be auto-populated based on the selection of financial year Provide the amount of PTEC.

- Select the location and provide the mobile number.

- Once the details are provided, click on the Proceed for Payment.

Share List