Income Tax Act has a provision to impose penalty in case of default in furnishing the return of income for any assessment year commencing on or after 1st April 2018.

Section

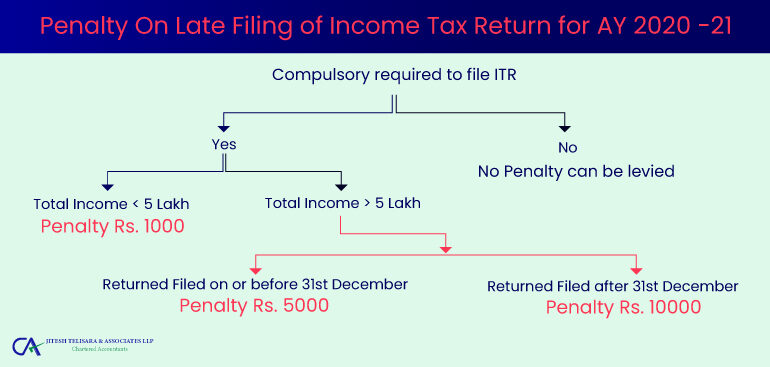

Income Tax Act under Section 234F states that where any person who is required to file the return of income under section 139(1) fails to do so will have to pay penalty by way of fee.

Amount of Penalty

Any person defaulting in filing the return of income on or before the due date will have to pay a penalty of Rs 5,000/- if such person files the return of income on or before 31st December of the assessment year.

However, a person who does not file the return of income even on or before 31st December of the assessment year, such person shall have to pay a penalty of Rs 10,000/- if such return is furnished after 31st December to 31st March of the assessment year.

Exception

Any person who has defaulted by not filing the return of income on or before the due date applicable for the assessment year, and has total income less than or equal to Rs 5,00,000/- the penalty amount shall not be more than Rs 1,000/-

It is always advisable to adhere to the timelines provided by the income tax department to avoid payment of penalty.

Jitesh Telisara & Associates LLP, CA In Kalyani Nagar is a professionally managed firm catering to domestic and international clients with a broad range of services in domestic and international taxation, regulatory and advisory services and crosses border transaction-related services.

The team at the firm has dedicated and experienced professionals and associates like Chartered Accountants, Company Secretary and Consultants to provide end to end services to your business. With the effort of gaining a deep understanding of your business, the team is committed to providing valuable, consistent and efficient services based on its in-depth knowledge and wide experience in the areas of audit, taxation, regulatory compliances, and related business services.

Our services: GST Consultant, IT returns consultant, Corporate law, Taxation, Regulatory & Advisory Services