Whenever we come across an individual who is suffering from disabilities, the first reaction of most people is to pity them. However, it should not be the case. There are many stories of individuals who, despite suffering from disabilities, have soared the heights of success.

However, it is no secret that their path to success was not easy. Our role as a community should be to encourage and support such people, without feeling pity for them, to live a life of dignity and fulfillment. Thus with the same intention, the income tax act of India provides certain special benefits under Section 80U to such individuals suffering from a disability.

Who can claim benefit under Section 80U?

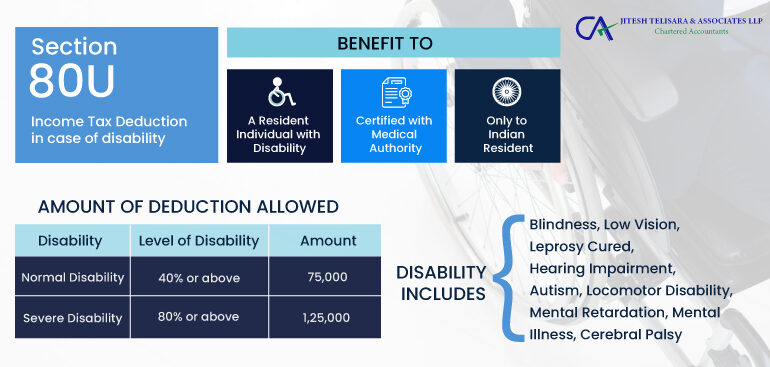

Any individual (Maybe a citizen of India Or foreign Country)who is a resident and in any previous year has been certified as a person with a disability by a medical authority can claim a deduction from the income chargeable to tax.

What is the definition of a person with a disability?

An individual is defined as a person suffering from disability if he/she suffers at least 40% of one or more of the following mentioned disabilities as certified by medical authorities:

- Blindness

- Low Vision

- Leprosy (Cured)

- Mental Health Condition

- Hearing Disability

- Locomotor Disability

- Autism

- Cerebral Palsy

- Multiple Disabilities

An individual is defined as a person suffering from a severe disability is he/she suffers 80% or more of the above-mentioned disabilities.

What is the quantum of deduction that can be claimed?

An individual suffering from a disability is eligible to claim a deduction of Rs 75,000/- while computing the total income.

An individual suffering from a severe disability is eligible to claim a higher deduction of Rs 1,25,000/- while computing the total income.

How can a deduction be claimed?

An individual claiming deduction under Section 80U shall have to submit a copy of the certificate in Form 10-IA issued by the medical authority for the disability suffered by an individual along with the copy of income tax return. Such an individual is not required to provide any other proof such as bills or reports of the disability.

Can an individual claim a deduction basis an expired certificate?

If an individual suffers from a disability that requires a re-assessment certificate provided by the medical authority shall be for a specific time-frame. Thus, after such certificate issued is expired, a fresh certificate shall have to be obtained from the medical authority to claim deduction under Section 80U by such an individual.

Jitesh Telisara & Associates LLP, CA In Viman Nagar is a professionally managed firm catering to domestic and international clients with a broad range of services in domestic and international taxation, regulatory and advisory services and crosses border transaction-related services.

The team at the firm has dedicated and experienced professionals and associates like Chartered Accountants, Company Secretary and Consultants to provide end to end services to your business. With the effort of gaining a deep understanding of your business, the team is committed to providing valuable, consistent and efficient services based on its in-depth knowledge and wide experience in the areas of audit, taxation, regulatory compliances, and related business services.

Our services: GST Consultant, IT returns consultant, Corporate law, Taxation, Regulatory & Advisory Services