Income Tax Act has broadly defined taxability of income under five heads of Income. One of them is Capital Gain, where gains arising out of sale of capital assets are taxable in the hands of the seller of the capital asset. However, with the intention of tax evasion, assesses started entering into an agreement with the buyer, where the sale value declared by the seller is less than the actual sale consideration. This led to loss of tax to the government, and thus to avoid this, section 50C and Section 56 (2)(x) was introduced as two sides of a coin. Section 50C states taxability of such cases in the hands of the seller while Section 56 (2)(x) specifies about the taxability of such transactions in the hands of the buyer.

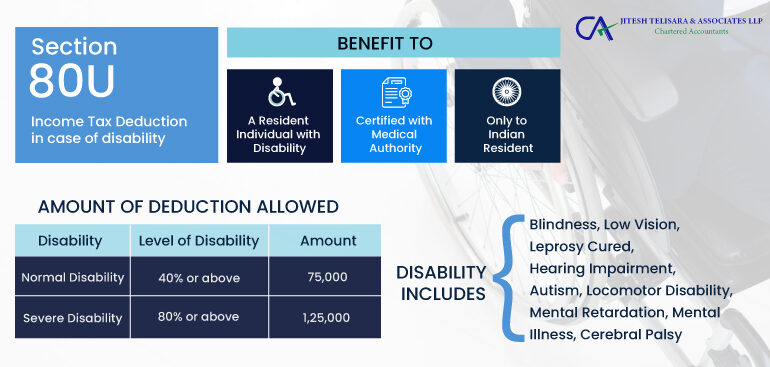

Whenever we come across an individual who is suffering from disabilities, the first reaction of most people is to pity them. However, it should not be the case. There are many stories of individuals who, despite suffering from disabilities, have soared the heights of success.

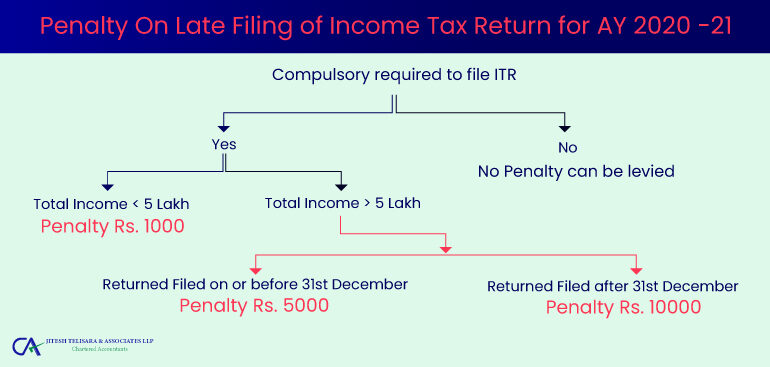

Income Tax Act has a provision to impose penalty in case of default in furnishing the return of income for any assessment year commencing on or after 1st April 2018.

Every person who earns income chargeable to tax should file its income tax return with the Income-tax Department before the due date and pay the taxes as applicable for the financial year. If any person fails to do so, such person shall be liable to pay interest as imposed by the Income Tax Act. Under the Income Tax Act, interest is imposed under three subsections of Section 234, viz., 234A, 234B, and 234C.

Every time a person files an Income Tax Return, an acknowledgement is generated. This acknowledgement is known as ITR-V. This means Income Tax Return Verification Form. Once the return is filed, it has to be verified either through Adhaar Based OTP or through net banking.

When the Goods and Service Tax Act was introduced, there were many doubts and clarifications were raised by industries as to what falls within the ambit of GST and what does not? GST is levied and applicable to the supply of goods and services.

Know the applicability of ITR Forms for AY 2020-21.

Ministry of Corporate Affairs has introduced DIR-3 e-KYC to conduct KYC verification for all the persons who have been allotted DIN (Director Identification Number). DIN is a unique 8 digit number allotted to a person who wishes to become a director of a company. Thus any person who holds a DIN is mandatorily required to file DIR-3 KYC with MCA.

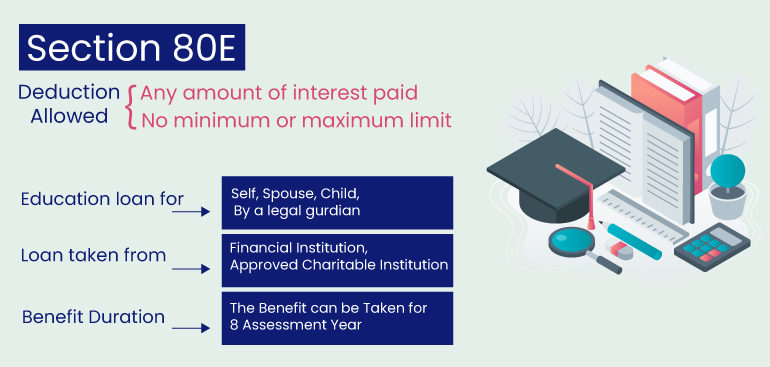

In today’s times, getting a higher education has become a point of concern where the fees for such education are touching the sky. As they say, the only thing costlier than education is ignorance.

Central Board of Direct Taxes announces an open window for one time to complete verification of ITRs filed electronically in the past years but is pending for verification.