Finance Act 2020 introduced Section 206C(1H), where a person who is a seller and receives consideration for the sale of goods of value or aggregate value which exceeds Rs 50 lakhs in the previous year shall, at the time of receipt of money, collect TCS at the rate of 0.1% of the value exceeding Rs 50 lakhs.

TCS shall be collected at the rate of 1% where the buyer has not submitted the PAN. Seller for this section has been defined as a person whose total sales or gross receipts or turnover from the business carried on by him exceeds Rs 10 crore during the previous financial year and such sale is not made to any person as may be notified by the Central Government in this behalf.

Finance Act 2021 introduced a new section 194Q that will be effective from 1st July 2021, making buyers responsible for deducting the Tax at Source in case of transactions of purchase of goods. Accordingly, any person who is a buyer who purchases any goods of value or aggregate value exceeding Rs 50 lakhs shall deduct TDS at the rate of 0.1% at the time of credit or at the time of payment, whichever is earlier.

Who is the buyer for Section 194Q?

Buyer is any person whose total sales or gross receipts or turnover from the business carried on by him exceeds Rs 10 crore during the financial year immediately preceding the previous year and not being any person as Central Government may notify in this regard.

Who is the seller for Section 194Q?

A seller for Section 194Q is any person who is a resident carrying on the business.

What is the Rate of TDS?

The buyer shall deduct TDS at the rate of 0.1% of the value exceeding Rs 50 lakhs. Incase where PAN is not provided by the seller, TDS shall be deducted at the rate of 5%.

What are the types of goods?

Goods for Section 194Q shall be both capital or revenue.

What are the exceptions to Section 194Q?

Section 194Q shall not apply to transactions:

- Where TDS is deductible under any other provision of Income Tax and

- Where TCS is collectible under Section 206C except 206C(1H)

At what time TDS shall be deducted?

TDS shall be deducted at the time of credit or at the time of receipt of the amount whichever is earlier.

What in the case of transactions where Section 206C(1H) applies?

In a case where both the buyer’s and seller’s turnover in the previous year exceeds Rs 10 Crore and the buyer purchases goods of value or aggregate value which exceeds Rs 50lakhs, Section 194Q shall prevail and have an overriding effect over Section 206C(1H). Thus it is the primary responsibility of the buyer to deduct TDS.

What are the effects of non-compliance with Section 194Q?

If the buyer fails to comply with this provision by not deducting TDS, 30% of the value of the transaction shall be disallowed as expenses.

When should the payment of tax deducted be done?

The tax deducted should be paid within 7 days from the end of the month in which the tax is deducted. The buyer shall also file a TDS return in Form 26Q every quarter.

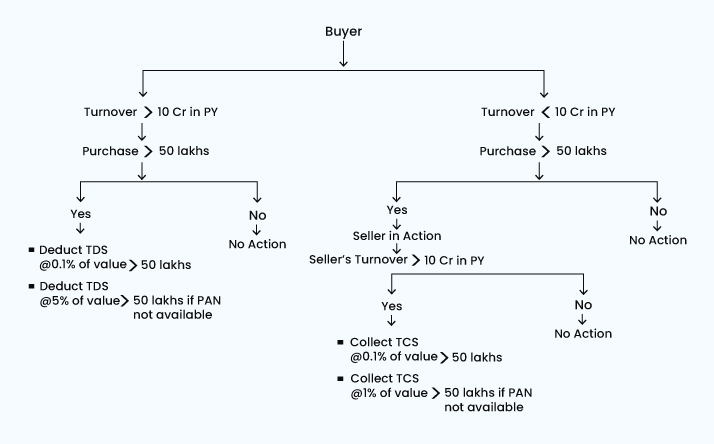

What is the Swing Mode between Sec 194Q and Sec 206C(1H)?

Below mentioned scenarios can explain the swing mode between Sec 194Q and Sec 206C(1H). We assume that the seller is a resident and the transaction value between the buyer and the seller is Rs 60 Lakhs in all the scenarios.

| SR No | Turnover of the Buyer in the previous year | Turnover of the Seller in the previous year | Applicable Section | Action to be taken |

| 1 | Rs. 12 Crore | Rs. 8 Crore | 194Q | Buyer will deduct TDS at 0.1% of Rs 10 lakhs at the time of credit or receipt of amount whichever is earlier. |

| 2 | Rs. 8 Crore | Rs. 12 Crore | 206C(1H) | Seller will collect TCS at 0.1% of Rs 10 lakhs at the time of receipt of the amount |

| 3 | Rs. 8 Crore | Rs. 5 Crore | None | No action required on either part as none of the sections is applicable |

| 4 | Rs. 12 Crore | Rs. 15 Crore | 194Q | Section 194Q has an overriding effect over 206C(1H). Thus buyer shall deduct TDS at 0.1% of Rs 10 lakhs at the time of credit or receipt of amount whichever is earlier. |

Jitesh Telisara & Associates LLP, CA In Viman Nagar is a professionally managed firm catering to domestic and international clients with a broad range of services in domestic and international taxation, regulatory and advisory services and crosses border transaction-related services.

The team at the firm has dedicated and experienced professionals and associates like Chartered Accountants, Company Secretary and Consultants to provide end to end services to your business. With the effort of gaining a deep understanding of your business, the team is committed to providing valuable, consistent and efficient services based on its in-depth knowledge and wide experience in the areas of audit, taxation, regulatory compliances, and related business services.

Our services: GST Consultant, IT returns consultant, Corporate law, Taxation, Regulatory & Advisory Services